A spring maintenance checklist for your business

Canadian winters can take their toll, especially when it comes to your business property and vehicles. Now that spring is upon us, the changing season

Product recall, damaged tools, and liability issues that come with faulty products can complicate matters quickly, whether you manufacture auto and truck operating parts, body parts, reefers, or other vehicle accessories. Make sure your tools and machinery are covered – as well as the work itself – by adding some specialized extensions to your basic Commercial General Liability (CGL), Property, and Auto insurance coverage.

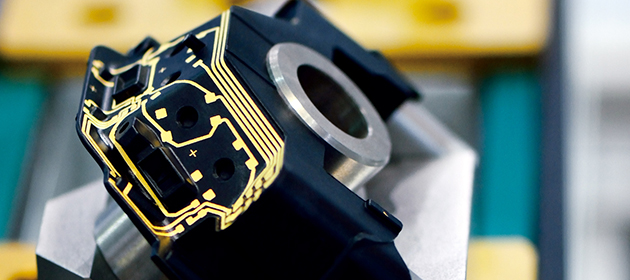

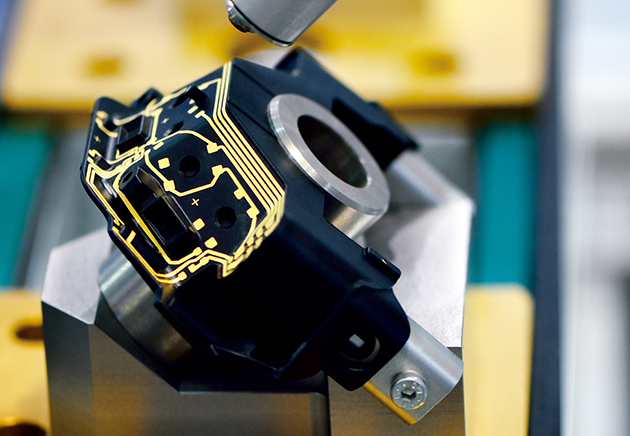

Precise tool, multi-step processes, and critical vendor relationships can make the manufacturing of non-critical auto parts a difficult job. We’ve compiled a policy to address common challenges, concerns and demands at each step of the way, with coverages like:

Your business relies on your skill and care as much as it relies on your specialized equipment: if you make a small mistake in the production phase, it could compromise the finished vehicle, and the blame could fall on you.

Need more? No problem.

We have some automatic extensions too, like Product Recall Expense, Negative Publicity, and Defective Goods Repair or Replacement Extension for claims made.

Working with expensive moulds, dies, forms, and patterns can be risky. If your customer supplies you with dies to make a certain auto body part, you could be responsible for the safety of the dies – even if you were to lend them to another company who was helping with the project. If a fire breaks out at that subcontracted plant and destroys those dies, you could be responsible for the costly consequences.

Our Moulds and Patterns coverage provides full replacement cost for dies, moulds, patterns, models, and forms at any location in Canada or the United States, whether it’s your own workspace or another company’s property.

When you work with precise parts and complex machinery, defects can happen, and sometimes they go unnoticed for a while. If your auto parts were turning out with rough and sharp edges, causing you to suspect a defect in your production process, you may decide to suspend production and recall the parts.

Recalling a product is no easy feat – and it can get expensive. With Product Recall Expense coverage, a parts manufacturer would be covered for some of the expenses involved in recalling a defective product, and Manufacturers and Wholesalers Product Impairment coverage would reimburse the manufacturer’s loss of business income (up to $50,000) that comes from the recall.

If you work with a computer system, you’re vulnerable to cybercrime – regardless of your industry. For instance, an auto parts manufacturer’s computer system could transmit a virus through its integrated inventory management software, disrupting the data that reaches customers. If those customers are unable to manage orders and inventory, they could lose a significant amount of income and sue you for damages.

Our Cyber Risk policy will help you here. It offers protection against lawsuits that stem from the transmission of computer viruses, helping your business stay afloat. Cyber Risk can also protect against losses resulting from network security breaches, privacy breaches, and internet media liability, plus policyholders have access to a consultation from a leading data risk management provider at no additional cost.

We know that the risks your non-critical auto part manufacturing business faces are different that the risks affection other manufacturing businesses. We also believe that you can help to defend against your unique set of risks with the right information and some smart guidance.

Our value-added services focus on helping you identify and mitigate the risks your business faces each day. An assessment of your protection systems, hazardous materials, and best practice risk control measures can help uncover the inherent risks associated with the equipment and materials you use. In-person consultations carried out by experienced risk services professionals can leave you with the knowledge and confidence you need to protect every aspect of the business you’ve worked so hard to build.

Canadian winters can take their toll, especially when it comes to your business property and vehicles. Now that spring is upon us, the changing season

In 2021, there were 202 fire-related deaths in Canada. Residential fires accounted for every 3 out of 4 of those fatalities. But many of these

Water issues can arise due to a number of different causes, including precipitation, weather-related events, underground sources, and improperly installed pipes during construction. If uncontrolled

In order to offer a better experience, please confirm your location