A spring maintenance checklist for your business

Canadian winters can take their toll, especially when it comes to your business property and vehicles. Now that spring is upon us, the changing season

You want ample, accurate and affectable coverage for your business. That’s why we’ve made it our business to become the partner of choice for the manufacturing and resources sector, with a manufacturers’ insurance policy to suit your needs.

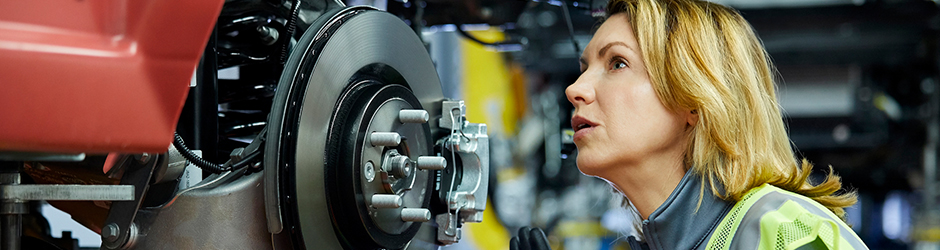

Your business rests on expensive production machinery, but that’s just one piece of the puzzle. We’re here to help protect your livelihood with auto part insurance coverage to address problems that can arise in the workshop and beyond.

Between advancing computer graphics, computerized printing, and shifting markets, it can be difficult to keep on top of your evolving insurance needs, but we can help you stay on the cutting edge.

When you mix, pour, move, or install concrete and cement, you face risks at every point of the manufacturing process – from raw goods to finished products. Are you sure you’ve covered all your bases?

Food and beverage manufacturing depends on specialized equipment and exceptional quality control, and there can be costly consequences when things go wrong in either camp. The food and beverage industry is evolving – shouldn’t your insurance coverage?

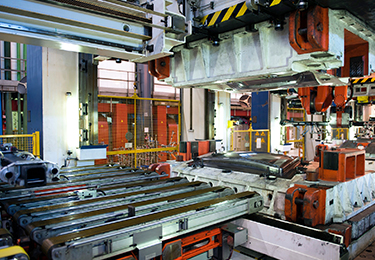

Your operations rest on expensive production machinery – so do your profits and reputation. Learn what coverage can help your machinery and equipment business stay in gear.

Whether you manufacture small parts or larger components, you face risks at every step of the manufacturing process – from raw goods to finished products. We offer specialized coverage that addresses the unique needs of metal manufacturers.

Whether you work with corn, carrots, or canola, your farm faces different risks and challenges than other types of manufacturing companies. We’re here to help protect your livelihood with coverage to address problems that can arise in the fields.